|

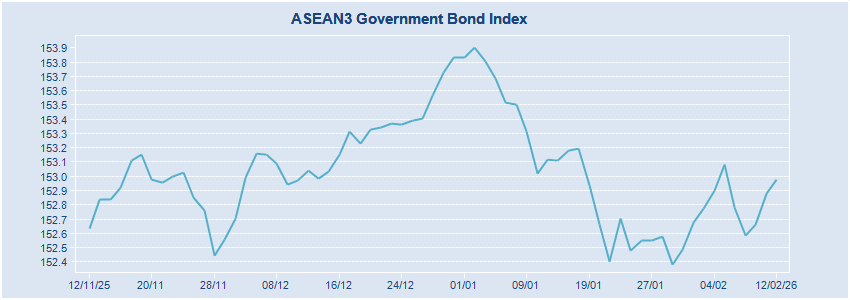

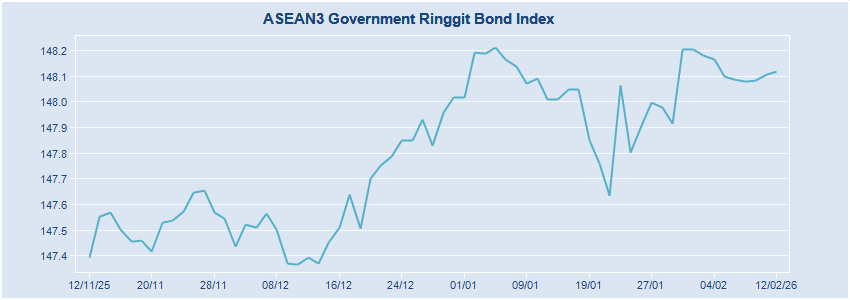

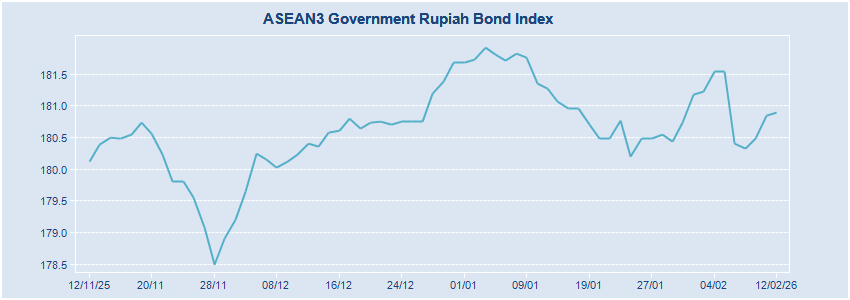

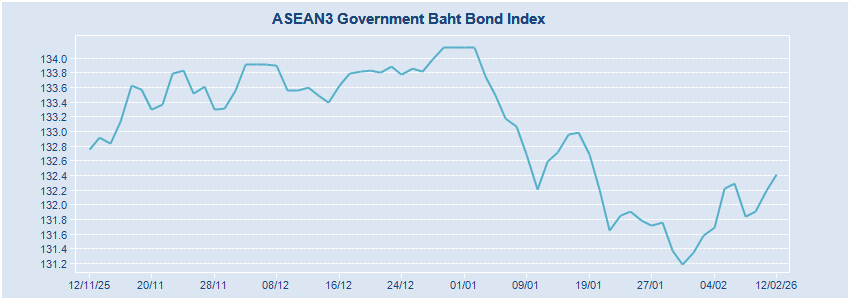

ASEAN3 Government Bond Index Daily Snapshot as at 12 February 2026

|

| |

Over the past decade, local currency bond markets in the Association of Southeast Asian Nations (ASEAN) have been growing and strengthening greatly. The investment universe has become larger while the diversity of issuers has increased, market liquidity deepened and investors’ diversification benefits improved. As at end of 2017, the combined market size in dollar terms reached USD1.229 trillion from a mere USD569.01 billion in 2006. Foreign holdings of debt securities outstanding have likewise increased in tandem from year to year.

With this background, the need for reliable and sophisticated data sets to measure and track market performance has been equally important. This environment formed a perfect setting for cooperation between the bond pricing agencies in the ASEAN region. Beginning since 2012, Penilai Harga Efek Indonesia, Bond Pricing Agency Malaysia and the Thai Bond Market Association have been collaborating to share and promote market data. In 2017, these three entities came together to develop a new bond index called the ASEAN3 Government Bond Index (A3GBI).

The A3GBI tracks the local currency denominated government bonds in the 3 largest markets of the ASEAN region which are Indonesia, Malaysia and Thailand. Daily pricing is sourced from the accredited bond pricing providers in each country - Penilai Harga Efek Indonesia, Bond Pricing Agency Malaysia and the Thai Bond Market Association. Compared to other similar indices, the A3GBI incorporates independent data of the highest quality which is fully verifiable. The index provides a relevant benchmark that is stable, comparable to other markets, easily replicable and clearly measureable in assessing investment opportunities.

|

|

About ThaiBMA

The Thai Bond Market Association (ThaiBMA) is a securities business related association under the Securities and Exchange Commission Act B.E. 2535. Its main purposes are to be a self-regulatory organization (SRO) for a fair and efficient operation of the bond market. ThaiBMA also functions as an information center and pricing agency for the Thai bond market. It takes leading roles on setting market convention, promoting education and market development and provides vehicles for policy dialogue among the industry and other related parties on issues concerning market development.

|

| |

|

About PHEI

Penilai Harga Efek Indonesia (PHEI) is a Securities Pricing Agency (SPA) established to promote transparency in Indonesia Bond Market and financial industry. Operating based on license granted by Otoritas Jasa Keuangan (Indonesia FSA), PHEI is striving for a better, more reliable and more accountable price discovery mechanism in Indonesia financial industry. In delivering its services such as but not limited to bond and sukuk fair prices, bond research reports, series of bond indexes, and other bond related data, PHEI is always committed to serve the market in objective, independent, reliable and transparent manner. Visit us at www.ibpa.co.id

|

| |

|

About BPAM

Bond Pricing Agency Malaysia Sdn. Bhd. [200401028895 (667403-U)](BPAM) is a registered Bond Pricing Agency as accredited by the Securities Commission of Malaysia. BPAM now stands as the premier source of evaluated prices and data for the Malaysian Fixed Income Market. Since 2005, BPAM has built an enviable reputation for independence, accuracy and service. With more than a hundred clients across the globe, BPAM is the first choice for fund managers, dealers, brokers and risk managers alike. For more information about BPAM, please visit us at https://www.bpam.com.my/

|

|

|