BPAM’s weekly bond market snapshot provides an overview of some key indicators of the Malaysian Ringgit bond and sukuk market.:

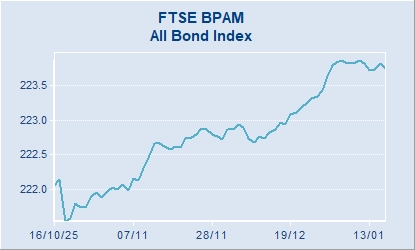

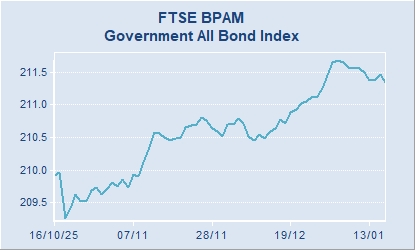

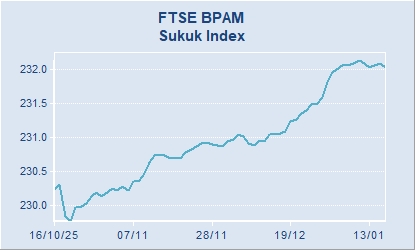

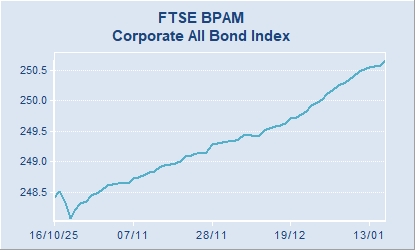

- FTSE BPAM Bond Index Charts: Show the performance of the All Bond, All Sukuk, All Government Bond and All Corporate Bond Indices over the week. It can be looked at the same way as a stock market index (ie. Up = Bull Market, Down = Bear Market)

- Constant Maturity YTM Curve Charts: Show the yield-to-maturity (YTM) curves for bonds and sukuk (ie the return for a given level of risk) for 1-30 year maturities. It is a measure of the return given by a bond for the price paid.

- The BIR (BPAM Market Implied Ratings) is a statistically derived rating scale based on the daily yield levels of the bonds and sukuk. It is fundamentally different from the Credit Rating (CR) as provided by Rating Agencies.The BIR and CR can be compared to obtain the deviations and notch changes.

This data is derived from the databases of Bond Pricing Agency Malaysia Sdn Bhd, a registered Bond Pricing Agency with the Securities Commission of Malaysia. For more information, visit www.bpam.com.my

WEEKLY RINGGIT BOND MARKET SNAPSHOT between 12/01/2026 to 16/01/2026

FTSE BPAM Bond Index Series

|

|

|

| Index Value (This Week Close): |

223.761 |

|

Index Value (This Week Close): |

211.353 |

| Index Value (Last Week Close): |

223.866 |

|

Index Value (Last Week Close): |

211.558 |

| Week On Week Change: |

-0.105  |

|

Week On Week Change: |

-0.205  |

| % Change: |

-0.047 %  |

|

% Change: |

-0.097 %  |

|

|

|

| Index Value (This Week Close): |

232.031 |

|

Index Value (This Week Close): |

250.660 |

| Index Value (Last Week Close): |

232.127 |

|

Index Value (Last Week Close): |

250.476 |

| Week On Week Change: |

-0.096  |

|

Week On Week Change: |

0.184  |

| % Change: |

-0.041 %  |

|

% Change: |

0.073 %  |

|

Constant Maturity YTM Curve

|

Constant Maturity Conventional Yield-To-Maturity

|

| MGS |

2.856 |

2.983 |

3.111 |

3.344 |

3.459 |

3.553 |

3.775 |

3.902 |

3.956 |

4.009 |

| Quasi-Govt |

3.207 |

3.280 |

3.347 |

3.453 |

3.577 |

3.673 |

3.880 |

3.993 |

4.063 |

4.133 |

| AAA |

3.420 |

3.500 |

3.550 |

3.640 |

3.730 |

3.790 |

3.940 |

4.060 |

4.140 |

4.210 |

| AA |

3.570 |

3.650 |

3.700 |

3.780 |

3.860 |

3.950 |

4.180 |

4.420 |

4.580 |

4.730 |

| A |

4.620 |

4.910 |

5.180 |

5.590 |

5.900 |

6.310 |

6.900 |

7.390 |

7.730 |

8.070 |

| BBB |

6.090 |

6.650 |

7.130 |

7.810 |

8.350 |

9.010 |

9.870 |

10.610 |

11.270 |

11.920 |

|

Constant Maturity Islamic Yield-To-Maturity

|

| GII |

2.888 |

3.045 |

3.162 |

3.314 |

3.427 |

3.583 |

3.799 |

3.885 |

3.961 |

4.039 |

| Quasi-Govt |

3.207 |

3.280 |

3.347 |

3.453 |

3.577 |

3.673 |

3.880 |

3.993 |

4.063 |

4.133 |

| AAA |

3.420 |

3.500 |

3.550 |

3.640 |

3.730 |

3.790 |

3.940 |

4.060 |

4.140 |

4.210 |

| AA |

3.570 |

3.650 |

3.700 |

3.780 |

3.860 |

3.950 |

4.180 |

4.420 |

4.580 |

4.730 |

| A |

4.620 |

4.910 |

5.180 |

5.590 |

5.900 |

6.310 |

6.900 |

7.390 |

7.730 |

8.070 |

| BBB |

6.090 |

6.650 |

7.130 |

7.810 |

8.350 |

9.010 |

9.870 |

10.610 |

11.270 |

11.920 |

|

BIR-CR Divergence Statistics on 16/01/2026

| Status |

BIR < CR |

BIR = CR |

BIR > CR |

| % |

38.00% |

40.00% |

22.00% |

|

| Note: 'BIR<CR' shows bonds where its BPAM Market Implied Rating (BIR) is worse than Credit Rating (CR), and vice versa. |

Top 10 BIR-CR Deviations for Traded Bonds of the Week

| TRADE DATE |

STOCK CODE |

STOCK NAME |

CR ON TRADE DATE |

BIR ON TRADE DATE |

CR-BIR DIVERGENCE |

CR-BIR NOTCH DIFFERENCE |

| 15-Jan-2026 |

US120031 |

GENTING CAP MTN 4.86% 08.6.2027 - Issue No. 2 |

AA1 |

A1 |

BIR < CR |

3 |

| 12-Jan-2026 |

UN170048 |

GENM CAPITAL MTN 3652D 31.3.2027 |

AA1 |

A1 |

BIR < CR |

3 |

| 15-Jan-2026 |

VP190295 |

MBSBBANK IMTN 5.250% 19.12.2031 |

A2 |

AA2 |

CR < BIR |

3 |

| 15-Jan-2026 |

UI240171 |

GENM CAPITAL MTN 1826D 31.5.2029 |

AA1 |

A1 |

BIR < CR |

3 |

| 15-Jan-2026 |

UI220099 |

GENTING RMTN MTN 1826D 25.3.2027 - Tranche 3 |

AA1 |

A1 |

BIR < CR |

3 |

| 14-Jan-2026 |

VN250133 |

GAMUDA IMTN 3.990% 27.03.2035 |

AA3 |

AAA |

CR < BIR |

3 |

| 15-Jan-2026 |

VG250615 |

BGSM MGMT IMTN 3.640% 22.12.2028 - Issue No 34 |

AA3 |

AAA |

CR < BIR |

3 |

| 13-Jan-2026 |

VI220179 |

MBSBBANK IMTN 4.360% 15.04.2027 |

A1 |

AA1 |

CR < BIR |

3 |

| 14-Jan-2026 |

UZ220144 |

HLBB Perpetual Green Capital Securities 4.45% (T3) |

A1 |

AA2 |

CR < BIR |

2 |

| 15-Jan-2026 |

VK250201 |

IMTIAZ II IMTN 3.980% 05.05.2032 |

AA2 |

AAA |

CR < BIR |

2 |

|

| Note: List shows traded bonds by Notch Difference and Market Capitalisation |

Top 10 BIR Notch Changes Over a Week

| STOCK CODE |

STOCK NAME |

CR ON END DATE |

BIR ON END DATE |

BIR ON START DATE |

END BIR - START BIR STATUS |

END BIR - START BIR NOTCH DIFFERENCE |

| PP240028 |

CIMBBANK 4.080% 26.09.2036-T2 Sukuk Wakalah S7 T2 |

AA2 |

AA2 |

AA3 |

UPGRADE |

1 |

| PP240030 |

CIMB 4.080% 26.09.2036-T2 Sukuk Wakalah S7 T2 |

AA2 |

AA2 |

AA3 |

UPGRADE |

1 |

| VK250201 |

IMTIAZ II IMTN 3.980% 05.05.2032 |

AA2 |

AAA |

AA1 |

UPGRADE |

1 |

| VN240254 |

JOHOR PLANT IMTN 4.040% 26.09.2034 |

AA1 |

AA1 |

AAA |

DOWNGRADE |

1 |

| UX160124 |

YTL CORP MTN 7305D 11.11.2036 |

AA1 |

AA1 |

AA2 |

UPGRADE |

1 |

| VN230240 |

GAMUDA IMTN 4.400% 20.06.2033 |

AA3 |

AAA |

AA1 |

UPGRADE |

1 |

| VS240255 |

JOHOR PLANT IMTN 4.190% 26.09.2039 |

AA1 |

AA1 |

AAA |

DOWNGRADE |

1 |

| VN210150 |

MIDCITISUKUK IMTN 4.000% 23.04.2031 |

AAA |

AA1 |

AAA |

DOWNGRADE |

1 |

| VK200181 |

PTP IMTN 3.300% 27.08.2027 |

AA2 |

AA1 |

AAA |

DOWNGRADE |

1 |

| UP250343 |

GELM MTN 4383D 18.12.2037 |

AA1 |

AA2 |

AA1 |

DOWNGRADE |

1 |

|

| Note: List is by Notch Difference and Market Capitalisation |

Disclaimer

Information on this page is intended solely for the purpose of providing general information on the

Ringgit Bond market and is not intended for trading purposes. None of the information constitutes a

solicitation, offer, opinion, or recommendation by Bond Pricing Agency Malaysia Sdn Bhd [200401028895 (667403-U)] to buy or sell any security, or

to provide legal, tax, accounting, or investment advice or services regarding the profitability or

suitability of any security or investment. Investors are advised to consult their professional

investment advisors before making any investment decision. Materials provided on this page are provided

on an "as is" basis, and while care has been taken to ensure the accuracy and reliability of the

information provided in this page, Bond Pricing Agency Malaysia Sdn Bhd [200401028895 (667403-U)] provides no warranties or representations

of any kind, either express or implied, including, but not limited to, warranties of title or implied

warranties of fitness for a particular purpose, accuracy, correctness, non-infringement, timeliness,

completeness, or that the information is always up-to-date.

|